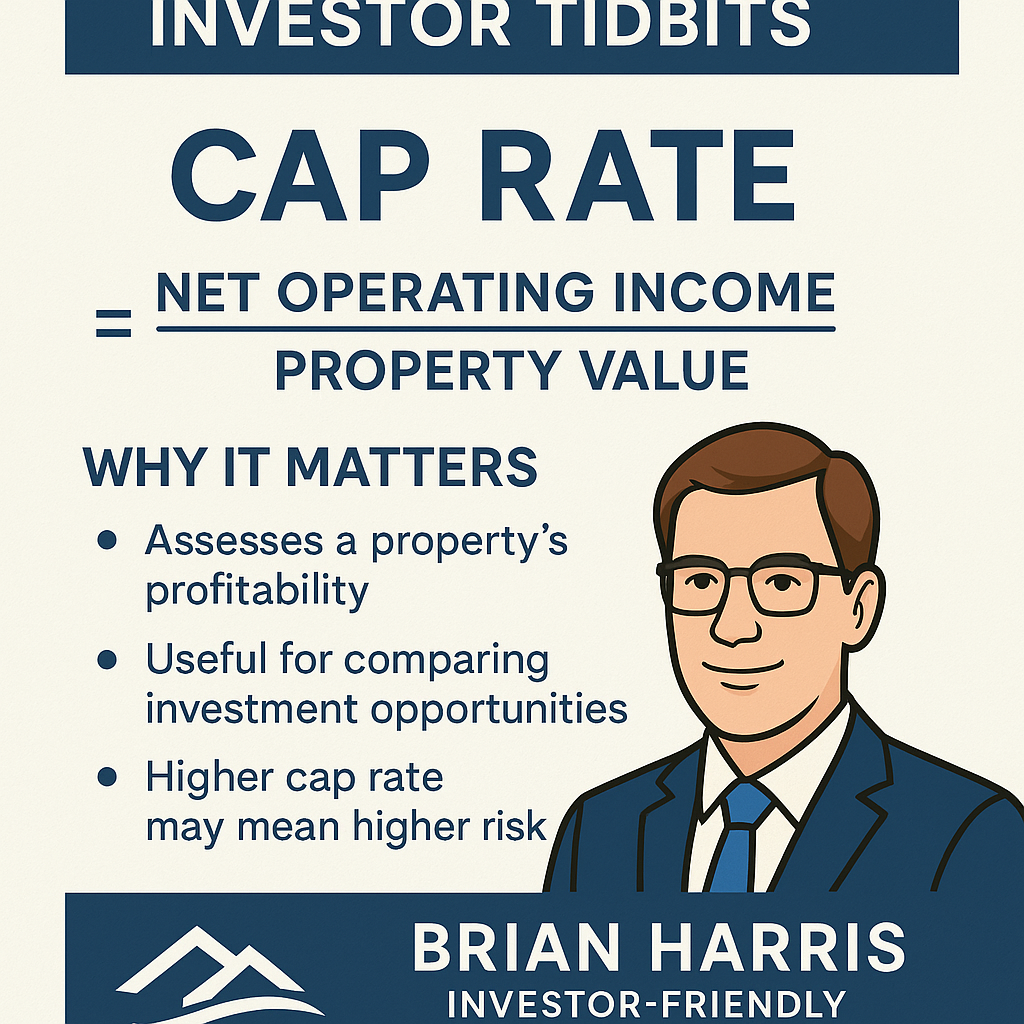

Understanding Cap Rate (Capitalization Rate)

By Brian Harris – Investor-Friendly Real Estate Agent, Phoenix, AZ

What is Cap Rate?

Cap Rate (Capitalization Rate) is a fundamental metric used to evaluate the expected return on a real estate investment, without considering debt.

Formula:

Cap Rate = Net Operating Income (NOI) / Current Market Value (or Purchase Price)

Why It’s Important

Compares Properties Quickly: Cap Rate helps investors evaluate how much income a property is expected to generate relative to its price.

Debt-Agnostic: It provides a neutral view, not influenced by mortgage terms or financing.

Risk Indicator: Higher Cap Rates often indicate higher potential returns but come with more risk; lower Cap Rates suggest stability and predictability.

Example:

You’re considering a Phoenix duplex priced at $500,000. It generates an NOI of $35,000/year.

Cap Rate = $35,000 / $500,000 = 7%

That 7% is your expected annual return if you bought the property in cash. Compare that to other Phoenix-area opportunities and you can quickly identify which ones are priced right or worth a deeper look.

What’s a Good Cap Rate?

In Phoenix’s current market (Q3 2025), Cap Rates typically range from 5%–8% depending on location, condition, and tenant quality.

A lower Cap Rate might be acceptable in high-demand areas or when appreciation is strong.

A higher Cap Rate may offer better short-term cash flow but might reflect a less stable tenant base or greater maintenance needs.

Final Thoughts

Cap Rate is one of many tools smart investors use to evaluate opportunities — but context matters. Pair it with market trends, financing terms, and your long-term goals.

As your investor-friendly real estate expert here in Phoenix, I help you see the full picture — not just the numbers.

📞 Contact Me Today

Brian Harris

Investor-Friendly Real Estate Agent

📍 Phoenix, AZ

📧 [email protected] | 📞 602-684-0198

🌐 www.azdreamsource.com